Concerns about Heckler & Koch’s finances have lingered for years, but late in 2016 Moody’s changed the company’s outlook from negative to positive. This was reflected by factors like improvements in operating performance, internal cash generation and strategy.

HK’s product portfolio is certainly one of the strongest in the market. There are some very interesting projects sold and bagged, to be delivered, but the company has a few very interesting years ahead to harvest their new portfolio.

Already 15 years ago, back in 2002, Heckler & Koch was acquired by Andreas Heeschen and Keith Halsey. Mr. Heeschen is a majority shareholder of Heckler & Koch who is said to live in London.

This is the latest Press Release: Heckler & Koch successfully completes the capital increase for H&K AG and the refinancing of the bond

October 5, 2017. The capital increase for H&K AG, the parent company of the Heckler & Koch Group, resolved by the shareholders’ annual general meeting on August 15, 2017 has come into effect by respective registrations with the commercial register (cf. our ad hoc release of July 6, 2017). The share capital has been increased by €6,640,920.00 from €21,000,000.00 to €27,640,920.00.

In the course of the capital increase 6,640,920 new shares are issued, a portion of 6,637,587 shares in the course of the resolved capital increase against contribution in kind and the remaining 3,333 shares in the course of the resolved cash capital increase.In accordance with the resolution of the general meeting, the new shares from the capital increase against contribution in kind were subscribed for by the company’s major shareholder, Mr Andreas Heeschen, and the new shares from the cash capital increase were subscribed for by other shareholders of the company. The new shares from the capital increase are intended to be included in the current listing on the Euronext segment of the Paris stock exchange.

As previously reported, the debt instruments foreseen to contribute to the refinancing of the previous bond have already been made available and the bond has been redeemed in full. With the registration of the capital increase having occurred, the last step of the planned refinancing of the bond has been completed.

About Heckler & Koch

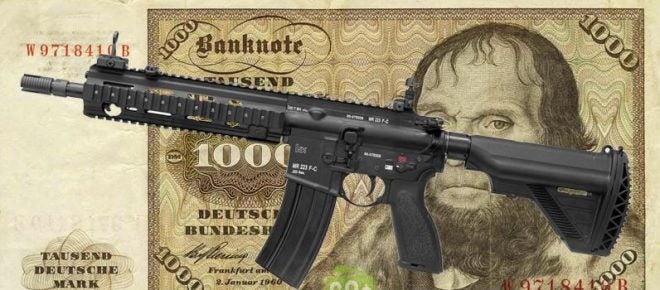

The Heckler & Koch Group, in operation for more than 65 years, is a leading manufacturer of small arms with a premium quality product portfolio for the armed forces of the EU, of NATO countries and of NATO-equivalent countries. The Heckler & Koch Group designs, produces and distributes small arms, including rifles, side arms, sub-machine guns, machine guns and grenade launchers.

You can find one of Moody’s previous statements here: Moody’s changes Heckler & Koch GmbH’s outlook to positive from negative

Your Privacy Choices

Your Privacy Choices