Ammunition subscription services were a popular way for a lot of customers to order ammunition regularly so they could either keep shooting regularly or simply stock up over time with the various monthly subscription tiers. However, with an increasing amount of people looking for alternative stores of wealth that aren’t either purely intangible or easily sold, AmmoSquared has decided to make the pivot from a subscription-based business model, to a bank account based business model using ammunition as the storage model for wealth.

More Ammunition Articles @ TFB:

- Speer Ammunition Awarded Contract to Provide Ammunition to the NYPD

- Winchester Awarded NGSW Ammunition Production Contracts by the US Army

- New Knock Down Series Big Game Ammunition from Fiocchi

Ammo Bank Accounts? AmmoSquared Pivots from Subscription Model

Nampa, ID – AmmoSquared, a pioneer in the ammunition industry, is evolving from its ammo subscription roots toward an ammo bank account based business model. This transition is driven by the increasing number of people looking for asset backed alternatives to traditional paper based savings account options.

AmmoSquared’s success and resilience during the 2020 ammunition shortage was due to the millions of rounds stored on behalf of customers, demonstrating the very real value of its innovative ammunition storage model. Customers with ammo already stored up didn’t need to worry about the widespread ammunition shortages that struck the gun industry. Throughout the years customers have used the AmmoSquared subscription service and platform for longer term ammunition storage. Essentially an ammunition asset account or “ammo bank”. AmmoSquared customers have the option to take delivery of their ammunition “savings” or sell it back and turn their ammunition assets into cash with the push of a button.

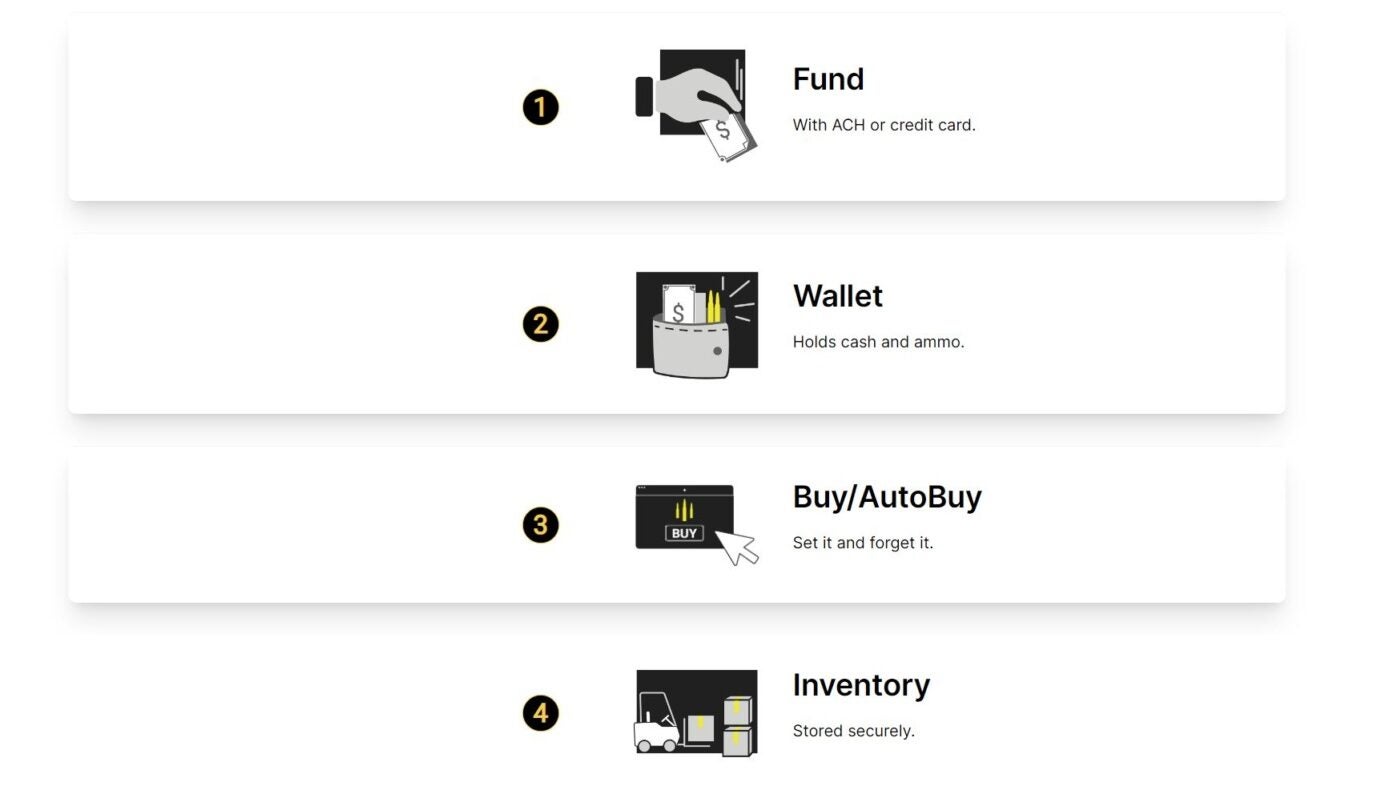

This shift in customer preference over the years has led AmmoSquared to recently refine its services and adapt to the changing needs of its customers. The platform now offers features usually seen in financial products, such as limit buy and sell orders, a dashboard displaying gains and losses on calibers, and the ability to exchange one caliber for another. In addition, ACH and e-wallet features have been added to facilitate moving money into and out of ammunition seamlessly.

This type of subscription service could potentially give firearms enthusiasts a more practical route to diversifying their assets in addition to or perhaps as an alternative to more traditional investments like CDs, precious metals, art, or even cryptocurrency. If you’d like to learn more about AmmoSquared’s approach to not just wealth management, but also ammunition management, you can learn more about their ammo bank account services at AmmoSquared.com.

Your Privacy Choices

Your Privacy Choices