Earlier this month, TFB reported that American Outdoor Brands was preparing to spin-off from Smith & Wesson. That recent news makes Smith & Wesson‘s financials even more interesting than usual, and they have announced that current reports are in with a June 18th press release. Due to the volume of information, only a portion will be included below, with the full release available via the preceding link to Smith & Wesson’s investor relations page.

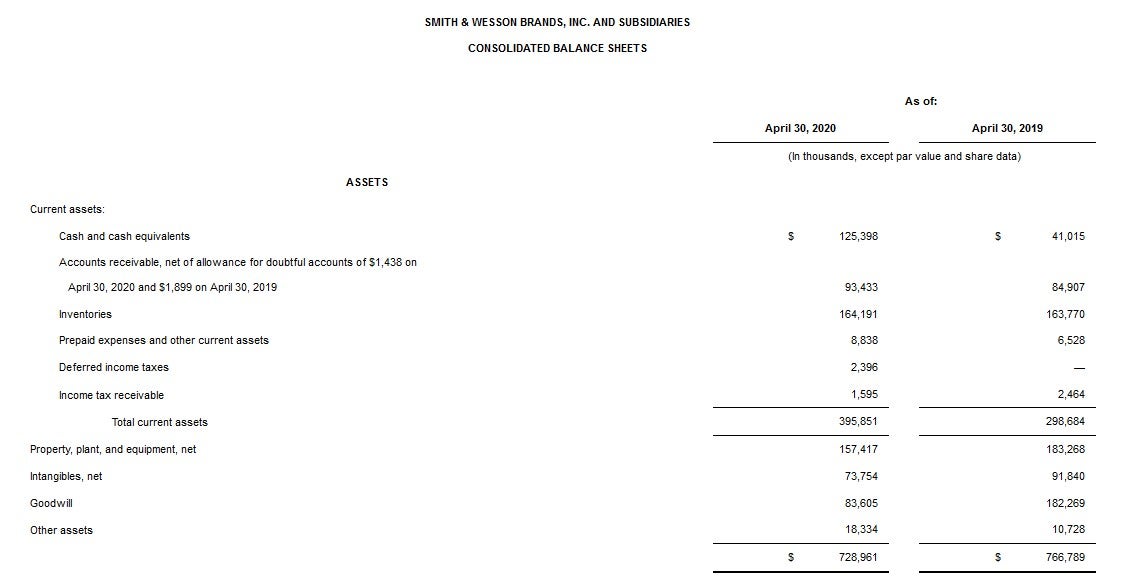

SWBI’s balance sheets show their assets…

SPRINGFIELD, Mass., June 18, 2020 /PRNewswire/ — Smith & Wesson Brands, Inc. (NASDAQ Global Select: SWBI), one of the world’s leading providers of firearms and quality products for the shooting, hunting, and rugged outdoor enthusiast, today announced financial results for the fourth quarter and full year fiscal 2020, ended April 30, 2020.

Full Year Fiscal 2020 Financial Highlights

- Full year net sales were $678.4 million compared with $638.2 million last year, an increase of 6.3% from the prior year. The change related to the timing of federal excise tax favorably impacted net sales in the year by $37.5 million. That change had no impact on gross margin dollars or operating expenses.

- Gross margin for the year was 34.6% compared with 35.4% last year. Excluding the change related to the timing of federal excise tax, gross margin for the year would have been 36.7%, or an increase of 120 basis points over last year.

- Full year GAAP net loss was $(61.2) million, or $(1.11) per diluted share, compared with GAAP net income of $18.4 milliion, or $0.33 per diluted share, for last year. The $98.7 million non-cash impairment charge taken in the fourth fiscal quarter negatively impacted basic and diluted earnings per share by $1.79.

- Full year non-GAAP net income was $45.5 million, or $0.82 per diluted share, compared with $45.9 million, or $0.83 per diluted share, for last year. GAAP to non-GAAP adjustments to net income exclude a non-cash impairment of goodwill in the Outdoor Products & Accessories segment as well as costs related to the planned spin-off of that segment, COVID-19 related expenses, and other costs. For a detailed reconciliation, see the schedules that follow in this release.

- Full year non-GAAP Adjusted EBITDAS was $116.3 million, or 17.1% of net sales, compared with $111.3 million, or 17.4% of net sales, for last year. Excluding the change related to the timing of federal excise tax, non-GAAP Adjusted EBITDAS for the year would have been 18.1%.

Firearms Segment

Mark Smith, co-President and co-Chief Executive Officer, commented, “Strong consumer demand for firearms, as reflected by adjusted National Instant Criminal Background Check System (“NICS”) results, combined with a consumer preference for our innovative products, helped us deliver growth and market share gains in our firearms business in fiscal 2020. Our results were favorably impacted by changes in the timing of our excise tax assessment, as well as strong consumer acceptance of our M&P9 Shield EZ pistol, an expansion of our award-winning line of self-defense pistols in fiscal 2020. During our fourth quarter, we were able to keep our factories and distribution center operating, while our operational management teams implemented a broad range of safety procedures and cleaning protocols, which remain in place today, to significantly reduce risk of COVID-19 transmission and keep our employees safe. In addition, our internal inventory levels allowed us to address the sudden increase in customer demand for our firearms in the quarter, while we simultaneously engaged our component outsourcing partners and reactivated our flexible manufacturing model in preparation for ongoing strength in the consumer market for firearms.”

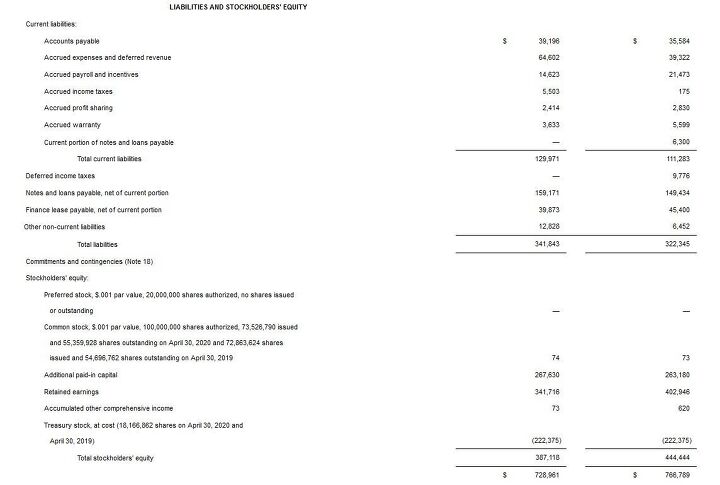

… as well as liabilities and stockholders’ equity. Additional spreadsheets accompany the full report.

Later, the release goes on to address the impending AOBC/SWBI split. It quotes CFO Jeffrey D. Buchanan as saying the spin-off is “On track for completion in August”. Whether your interest in Smith & Wesson is purely as a consumer, or you own SWBI shares and want to keep tabs on your stock, these reports can provide useful, informative data. When you’re finished gauging bulls and bears, I’ll see you at the range!

Your Privacy Choices

Your Privacy Choices