Most responsible firearms owners already take several measures to protect their gun collections. While guns are quite different from many of our other possessions, they are still just that – property. Firearms insurance is just another step that you can take to safeguard your treasured collection from unnecessary loss should something unthinkable happen to them (fire, theft, boating accident, etc). Today we’ll briefly explore what you can do to protect your firearms investments.

A Quick Guide to Firearms Insurance: How do you Insure Your Guns?

A Quick Guide to Firearms Insurance: How do you Insure Your Guns?

Today we’re specifically talking about insuring the guns themselves, not you in the case you have to use them. Liability insurance is the type of insurance that will help cover you for civil and criminal liability in the event you use your firearm in self-defense – even if you don’t have a concealed weapons permit.

A Quick Guide to Firearms Insurance: How do you Insure Your Guns?

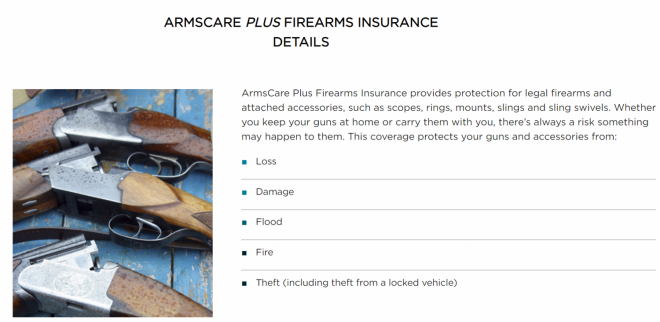

This type of insurance instead will cover the guns themselves in the event they are lost, stolen, or destroyed due to actions outside your influence such as a natural disaster or house fire. Even though these firearms would be covered, it’s still a good idea to further secure your collection with a high-quality gun safe and by using smart storage methods.

A Quick Guide to Firearms Insurance: How do you Insure Your Guns? Image Source: Sportsman Steel Safes

Find Out How much Your Guns Are Worth

Before ensuring your firearms you should probably find out what your collection is worth. Not just the entire collection but each individual firearm as well. The best way to do this would be to make a list or spreadsheet with each firearm and its associated value.

There are many resources both online and in print for valuing your firearms.

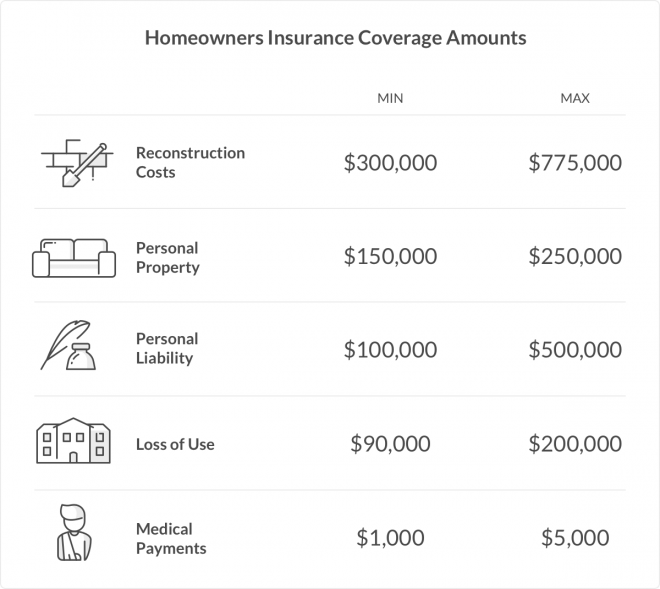

In one case if you feel like your collection isn’t massively valuable you could probably get away with standard homeowners insurance. This route will generally yield lower returns in the event that firearms are stolen or destroyed but also has the added benefit of being the easiest method as most will already have homeowners insurance.

Armed with the knowledge of your collection’s value, you should be able to determine what the best policy is for you. For most “gun guys” it will probably fall into a much more in-depth coverage situation where you’ll need to have your collection appraised and or hand over your serial numbers to the company in order for them to assess the total value of your firearms so that a proper policy can be drawn up.

Know the Type of Coverage you want

Even modestly sized collections can range in the tens of thousands of dollars as far as worth goes. With that in mind, do a quick tally in your head to see how much your collection comes up to. If your collection is worth more than just a few thousand dollars, you’re more than likely not going to receive back their full value or anything close to it in some cases.

Many insurance companies will indeed reimburse you for any lost firearms but often policy limits will reduce the amount you can receive both per firearm and as a grand total. This is why it is highly recommended that you call to get your firearms “scheduled” with the insurance agency.

Scheduling a Firearm with Your Insurance Company

You can add additional coverage for your firearms collection scheduling the firearm with your homeowners insurance policy. Most standard homeowners insurance policies place anywhere from a 1,000 to 10,000 limit for firearms but having your firearms schedule will allow you to exceed that coverage in the case of highly valued firearms like collectibles or just plain expensive guns.

A Quick Guide to Firearms Insurance: How do you Insure Your Guns?

A scheduled personal property endorsement is how you go about gaining additional coverage for your firearms. Some companies require an appraisal from an expert while other insurance companies will require a recent bill of sale or the serial number so they can do their own research. You should contact your personal insurance agent to find out exactly how the process works with your particular company.

Benefits of Scheduling your Firearms with your Insurance Company

There are several major advantages to scheduling your firearms with your insurance policy. The first of which is that most standard insurance companies don’t require a deductible to be paid on scheduled items and this can save you from having to pay anything to replace your lost item.

Secondly, scheduled items are often paid back at “replacement cost value.” This means that your insurance carrier will replace the lost firearm at the value it would be to actually purchase the new gun as opposed to unendorsed policies which almost always paid based on actual cash value meaning that the value of your gun is based on its replacement cost minus depreciation.

Finally, scheduled items often give you access to a broader zone of protection with regards to lost items. Instead of just being lost due to theft, natural disasters or fire, a scheduled firearm can often be replaced due to accidental loss.

Take Stock and Do Your Homework!

Although getting firearms insurance is a great idea to safeguard your investments, it’s not a foolproof method. The first step should always be securing your firearms properly to prevent damage or theft. Even scheduled firearms on a high-quality insurance policy can be placed on a maximum insurance value that does not fully cover the cost of the gun.

A Quick Guide to Firearms Insurance: How do you Insure Your Guns?

There are some good insurance companies out there that specialize in firearms insurance and I believe they are worth checking out if you don’t feel like combining your firearms insurance with your homeowners insurance. One company, in particular, Lockton Affinity Outdoor, seems like they specialize in this particular type of insurance.

I hope that this short guide to getting insurance for your firearms has been helpful. I’d be interested to know your personal experiences with firearms and insurance and specifically if you’ve ever had to make a claim. How did it work out? Was the full value of your firearm paid back? Let us know down in the comments! TFB Writer Austin Rex has personally had to make a claim on several of his firearms using insurance. If you’d like to ask him questions or get in touch with any of the other writers you can visit our discord server here.

Your Privacy Choices

Your Privacy Choices