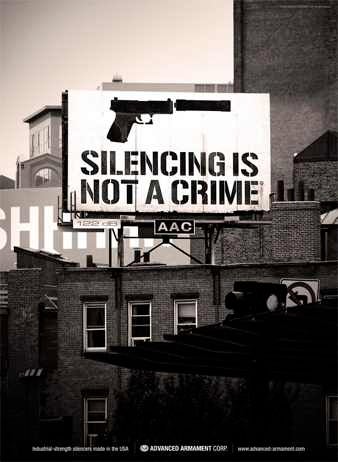

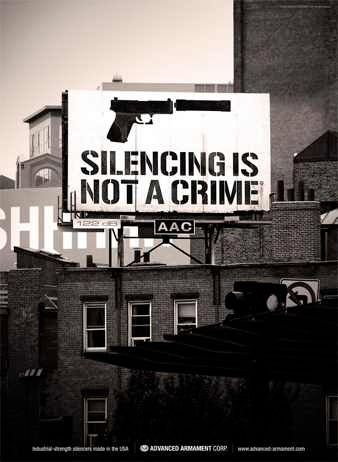

This was rumored and denied by founder Kevin Brittingham ( at least that is what I was told ) but the deal closed on 2 October and suppressor manufacturer AAC is now a division of Remington Military Products Division (MPD).

“We welcome Kevin and his team of engineers and designers on board,” commented Theodore (Ted) Torbeck, CEO of Remington and its parent, Freedom Group, Inc. “With the acquisition of AAC, we can enhance our research and development capabilities and deliver a more competitive product to the end user; further strengthening Remington’s position in the domestic and international markets.”

I think there will be many changes to AAC in the future. They have a unique company culture and I wonder if it will survive the Remington takeover.

Remington is owned by The Freedom Group, which is the firearm division of Cerberus Capital Management.

UPDATE:

Jason from ACC has just posted this on the ACC blog …

The crew that you know will still be here doing what we do. AAC is still AAC, but we will be moving into a brand new much larger space, and have access to more R&D and production resources than ever. We are really excited about what the future holds.

Don’t worry, we will continue to make cans for guns from every manufacturer and their various models- and stock and delivery issues will soon be a thing of the past! More news soon.

Your Privacy Choices

Your Privacy Choices