For those not an FFL, there is an annoying quirk in the system – one cannot get their Special Occupancy Tax (SOT or “Class III” which is an incorrect, but commonly used term) when they apply and receiver their FFL. Simply put, the ATF’s procedures do not allow one to apply for the SOT until they have received their FFL. This boggles my mind, as one would think the Government would want your money as fast as possible, right?

In terms of practical application, once you have your FFL, you can go purchase and sell firearms but anything that is covered by the National Firearms Act is off-limits until you go out and acquire the Special Occupancy Tax.

There are Two (2) Types of SOT:

As I covered in the original parts of the series, there are two real types of licenses that one can acquire. Most gun shops are a Dealer (Type 1) FFLs which allow them to get a Class III SOT. Manufacturers (which is the type of license I acquired) are a Type 7 license which allows them to get a Class II SOT.

There are critical differences between these licenses in relation to the SOT:

- Both allow the FFL to transfer into their possession NFA items without paying the $200 transfer tax for NFA items. If a FFL did not have a SOT, they can possess NFA items, but only after paying the tax like normal citizens.

- Normal “Type III” dealers are allowed to easily buy and sell SBR/SBS and Suppressors, but they cannot acquire a full-auto unless they have a “law letter” or request from a police department/LE agency for demo of a specific firearm. Type II SOT’s can transfer any full auto without issue.

- Type II SOTs are allowed to manufacture any item covered under the National Firearms Act and they notify the ATF of their manufacture within a business day. Type 01/Type III FFL/SOTs can only transfer in a NFA item after application and approval.

Your original FFL license will automatically determine the Type of the SOT. If one was originally a standard dealer, they will automatically receiver the Class III SOT. If one was a manufacturer, they will automatically receive a Class II SOT. A Type 07 can use their Class 02 as they normally would if they were a dealer, so its relatively common to see Type 07’s operating as dealers, especially when they “manufacture” their own AR-15s or other weapons under their own license.

In short, a Type 07 / Class II will be able to do everything a standard Type 01 / Class III is able to do and more.

SOT Validity

The SOT is valid only for a very specific timeframe, one calendar year starting from July 1st though June 30th. This validity is non-negotiable with the ATF, even if one were to apply for the SOT in March and receive it in June. That SOT would immediately expire June 30th, so if you are small, you may want to hold off on getting the SOT and applying for the upcoming tax year instead of right-away depending on the time of year.

What happens if I let my SOT expire?

Nothing. All NFA items in your possession are yours to keep and sell except for full-auto firearms. If you let your SOT expire and have a full-auto you must let the ATF know so they can pick up the full-auto firearm and dispose of it. Failure to report is a felony that the ATF does not joke around about (when they typically are good with FFLs so long as you contact them).

Suppressors, SBRs, SBS, etc can be sold to standard customers on the standard Form 4.

The exception to this is if the FFL company also closes. All assets of the company would have to be transferred out, even for single-member LLCs or single-owner Corporations. However, a FFL under an individual’s name is able to keep all the assets without paying the transfer tax as they were transferred to them personally in the eyes of the government.

The Process to Get the SOT is exactly the Same.

Once you have your FFL, the only additional step in the eyes of the government is to fill out the application for the SOT and to pay the tax stamp. Costs range from $500 (for standard Dealers, and Importers/Manufacturer’s whose revenues are less than $500,000) to $1,000 for high-revenue Importers and Manufacturers. A standard check or money-order is sufficient for payment included with the application.

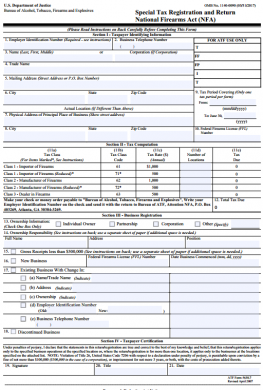

The Form for Special Tax Registration (The SOT)

The form itself is utterly simplistic, just make sure all the information on it matches the information that is on your actual FFL and the application used to apply for the FFL. Once received, it will typically take the NFA Branch about 4 weeks to process and mail you the SOT. It arrives just like the FFL, no pomp and circumstance at all.

Using the SOT

Once you have your SOT in hand, all one needs to do to start receiving in and reselling NFA items is to sign up with distributors that sell NFA items and submit your SOT with your FFL (see Part 8 for a list of distributors that play nice with small FFLs). The seller of the product is responsible for the appropriate transfer forms to the ATF, so once your SOT is on file for the year, its good go.

In my case, I typically turn to RSR group as they have excellent service, but a lot of suppressor manufacturers work direct with FFLs. Elite Iron and Liberty Suppressors come immediately to mind.

Your Privacy Choices

Your Privacy Choices