The online gun auction website Gunbroker.com will soon be implementing their new Marketplace Facilitator Sales tax regulations beginning on January 1st, 2021. In addition to this change, there will be several other changes that will be implemented on the site as well as a few proposed changes that might take place later in the year.

Gunbroker.com to Implement Automatic Sales Tax Collection for 2021

The following is from a December 4th posting on the Gunbroker Support Page:

GunBroker.com will implementing the new Marketplace Facilitator Internet Sales Tax regulations on January 1, 2021. As a marketplace, GunBroker.com will be required to collect and remit sales tax on all sales according to the state law.

What is a Marketplace Facilitator?

A Marketplace Facilitator is defined as an entity that provides a forum for sellers to promote their sale of physical property, digital goods, and services and is compensated for these services. As such, GunBroker.com is deemed to be a Marketplace Facilitator for sellers on the site.

What is Marketplace Facilitator Legislation?

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from the individual seller to the marketplace facilitator. As the Marketplace Facilitator, GunBroker.com will have to calculate, collect and remit state sales tax on sales sold by third party sellers for transactions destined to states where Marketplace Facilitator and/or Marketplace collection legislation is enacted.

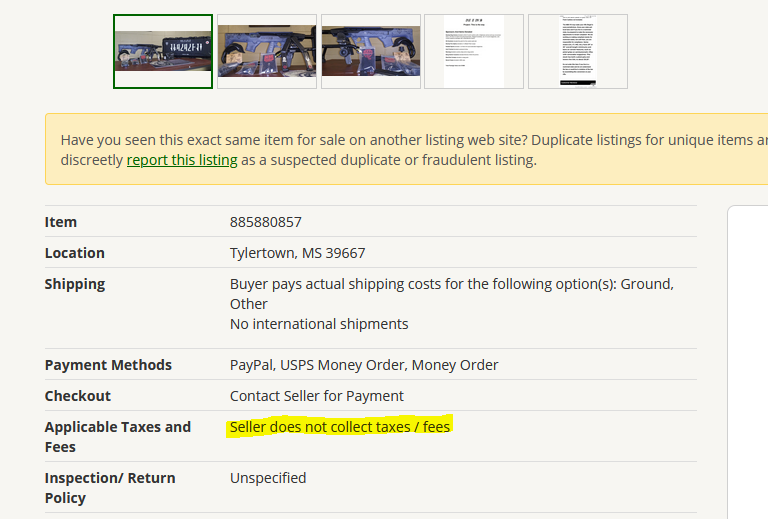

I think this might actually be a positive change for some of the smaller sellers on the site who are running a business, although I have a gut feeling that the reaction to this change might be pretty negative. I believe some will welcome the change as many sellers on Gunbroker already collect sales tax. Even though the number of states that already require sales tax to be added for online sales is continuing to shrink, there are still some out there that do not require it and this may cut into the margins for some online sellers. Exemptions still do exist, however, for non-profit organizations.

Some other proposed changes to the online experience for Gunbroker are as follows:

Recent Releases and Under Development:

- GunBroker Pay Auto Payment – Pay your GunBroker.com Fees with GunBroker Pay and receive a discount on your payment. Learn more here: https://www.gunbrokerpay.com/save/

- Updates to Order Grid – We are in the process of updating the order grid to include more information in less space. We will also color code status information and allow for the visible data to expand and collapse for easier viewing.

- Cash Discount / Credit Card Fee Name Standardization– We will be standardizing this name to Credit Card Fee. The site uses different name in different places so to make things clear, we will standardize on Credit Card Fee.

- Internet Sales Tax – GunBroker.com will begin collecting sales tax as a marketplace facilitator.

- New Online Listing Process – We are in the process of creating a new, responsive listing page that makes greater use of item defaults, allows for easier picture loading and working with standard text all in one place.

- Improved Credit Request Process – Changes to simplify and accelerate the credit request process are coming.

Items being Discussed or Defined:

- Require a picture for all listings

- Using the first picture as the thumbnail and not allowing a separate image

- Requiring the first picture be specifically of the item for sale

- Better display of shipping costs to make shipping comparisons easier for buyers.

- Require an FFL to be selected upon check out.

- Adding the ability for a Seller logo and business description in order to brand their listings better.

- Supporting rich text descriptions so it is easier to format listing details.

Questions or concerns about the above should be directed to SiteInfo@GunBroker.com. Thank you.

I quite like some of the items from the second list as a buyer on the site. One of the most frustrating things is having an image that is either only loosely related or completely unrelated to the product you’re searching for and that could lead to missed opportunities. However, I have to wonder if that particular rule might negatively impact sellers who use text images to describe what they are selling instead of an image of the actual item itself.

What are your thoughts on these new rules and the ones being discussed? Will these rules change the online experience of gun broker too much or will they add more value and clarity to the site? Thoughts and comments below.

Your Privacy Choices

Your Privacy Choices