The interview was quick and easy, and with the assurance that I was going to be approved, it was time to get the leg-work done in preparation for the incoming license. Fortunately, in my case, this was not too onerous of a task as the majority was just getting the company ready.

*Author’s note – We apologize for the series being published out of order (Part 8 was published prior to Part 7). It was a mix-up on scheduling articles.

Per the application for the FFL and the conversation with the IOI, an FFL has 30 days to be in full compliance with all local laws and registrations, of which the ATF is no help to ensure you are in compliance. In fact, they typically don’t check that you are in compliance and will only hit you with a chit if you are violating other ordinance’s (in much the same way firearms charges are typically “tacked on”).

While my company was in formal existence on paper, I did not have in-place any of the mechanisms by which the company would operate. There were a few major questions that needed resolution:

- How am I to accept revenue? How do I get paid?

- How am I to track the acquisition and disposition of assets, including serialized firearms?

- How do I manage accounting and the books?

Accepting Payment

To the first issue, most customers do not want to pay in cash for firearms. As such, I needed to set up the ability to take credit cards as payment. Prior to applying, I would need a bank account to manage my funds and accept the payment from the service provider. Off to the bank!

In my area, Chase Bank was the most generous in perks and benefits for creating a business account. With my Veteran status and personal checking accounts with them, it was easy to get a business account set up (by “easy”, I mean five hours and a head-aches’ worth of paperwork). Needing only a small deposit to get the account up and running, I was ready to start looking at credit card providers.

Most any bank will do well. Make sure to inquire that they are OK with you being a firearms-related company. A few banks will not want your business there.

Here was my first major stumbling block. I really wanted to use Square or the similar new-fangled dongles, but upon application, I was repeatedly denied as Square does not support firearms companies. Well, fooey (and if they dont want my money, I am sure as heck not going to give it to them).

Next, I attempted to use my bank, Chase’s, credit card system. I was denied there too, as they only would support credit card payments for firearms’ companies if I was going to be a brick-and-mortar store. As an online and appointment-only merchant, they were at least honest enough to say I was not worth the risk. Fair enough, I suppose (but odd considering that they were OK with the business account).

With my original plans dashed, I turned to a new FFL’s best friend, Google, to find a payment solutions provider. I stumbled across Payment Alliance International, which touted themselves and creating a division just for Federal Firearms’ Licensees. Turns out, PAI is part of the NRA Business Aliance and also endorsed by the NSSF. Knowing this, I was sure I was going to be good to go.

Author’s note: PAI set-up was easy, but for a small dealer, PAI does take just slightly higher fees. Fortunately, its common practice in the industry and legal to now charge a “credit card fee” like seen on GunBroker. Its annoying, but I passed this cost onto my customers.

PAI was good to go, as they typically settled at the end of each week (meaning I was not without the payment for longer than 7 days). This is a big deal, as most companies need to watch their cash flow like a hawk. Being paid, but not having access to the money is a major imposition. Other providers may provide decent terms, and Card Payment Options has an excellent run-down of gun-friendly providers.

Problem 1 down, onto problem 2.

Fortunately, this one was easy. There are two options for FFLs to managing their “bound books” which is either a) electronic or b) on-paper.

Being a techy, I originally opted to go electronic, but with the back-up requirements and the fact that my only computer was day-job owned, I suspected they would frown on the fact that I used their asset for outside business.

The IOI had some excellent recommendations for paper bound-books, and the gold-standard is BookFactory’s FFL Bound Book. The IOI’s loved them, as they had all the required columns and so long as one filed in each one, it was near impossible to screw up your book entries. I picked one up from Amazon for $19.99, eligible for prime.

The gold-standard in FFL bound books. I love mine and it works really well. One inspection by the ATF in and they found no issues.

Onto Issue #3

Not one to want to waste time, I wanted to find as automated a book-keeping solution as I could. To me, the program needed to be able to generate invoices, receipts, track expenses, and generally be no-hassle.

Going on Family’s recommendation, I went with QuickBooks online, which allowed me access to the books anywhere in the world (at the time, this was important, as I was travelling the world). It was nearly fully automated, tracking income and reconciling it with the specific sale.

For others, there are some other excellent options, especially in the small-business field. Capterra has a run-down of some of the most popular.

Waiting Game

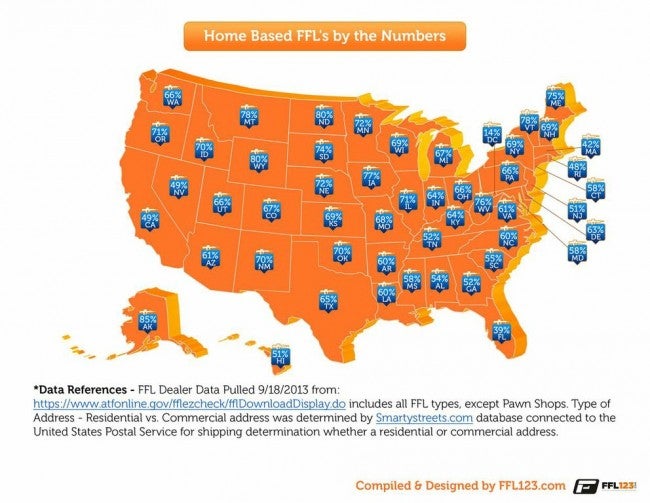

The above only took about two weeks to get off the ground, so I still had roughly 2-4 weeks remaining in the waiting game. To fill in the time, I started searching for home-based FFL friendly distributors, which turned out to be a frustrating task.

Will cover the list of how I found to be friendly in the next installment…

Your Privacy Choices

Your Privacy Choices