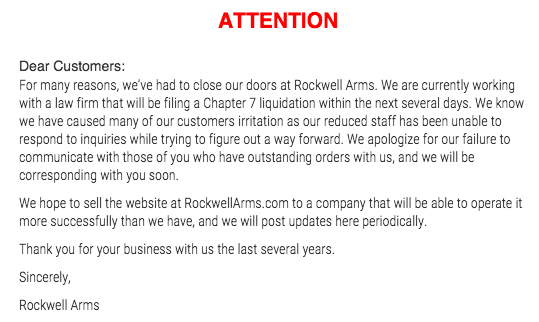

Rockwell Arms posted an announcement on its website that the company has stopped doing business and is in the process of filing for a Chapter 7 bankruptcy.

As I understand it, a Chapter 7 bankruptcy is a complete liquidation of the business by the court. As things are liquidated, creditors are repaid by the court up to, but frequently less than, the amount owed by the debtor.

It is my understanding that the company had been taking pre-orders for the SIG SAUER MPX line of firearms. It is not known if any of these customers – or those with other orders in limbo – will receive any kind of refund.

Thanks to TFB reader Troy for the tip.

Your Privacy Choices

Your Privacy Choices