Now Applying for FFL 07

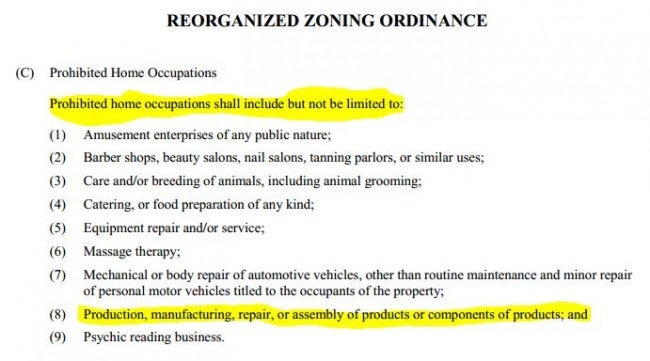

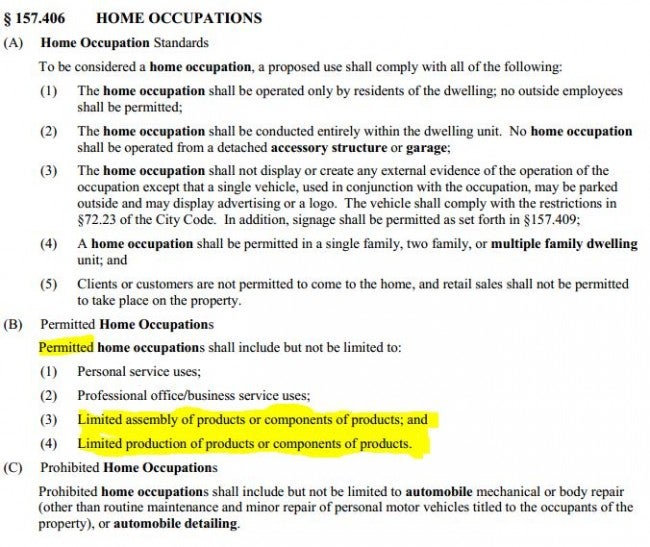

As part of my due diligence, I reached out to the local Planning Commission to verify and get a copy of the latest ordinances to submit with the FFL Form 7 application. Sarah, a Senior Planner forwarded me a copy of upcoming changes to the city codes taking effect April 4th (well after the FFL would likely be issued). The language is significant changed to allow “limited assembly” of components (i.e. assembling complete rifles from lower receivers).

A copy of the latest ordinance. The language is significantly broader and is designed to encourage local entrepreneurship and start-ups. The new language allows limited local production. This change clears me for a FFL 07.

Starting my Business

As we have covered numerous times, an FFL requires one to be “engaged in a business”. As such, I needed to start a business. There are four normal structures that businesses in the United States:

- Sole Proprietorship

- Partnership

- Limited Liability Company (LLC)

- Corporation

Each as their own distinct advantages and disadvantages. For details, see Entreprenuer.com.

Since I am starting a business based on guns, my principal concern is liability. Sole Proprietorships streamline taxation, but they pass on all liability to the owner. As such, I opted to form an LLC, which shields ownership from the liabilities and debts of the business. Your concerns or situation may be different. Contact your Chamber of Commerce and/or talk to a lawyer to figure out what structure is best for you.

Entreprenuership.com lists the major advantages and disadvantages or LLC’s:

Advantages of the LLC

- LLCs do not require annual meetings and require few ongoing formalities.

- Owners are protected from personal liability for company debts and obligations.

- LLCs enjoy partnership-style, pass-through taxation, which is favorable to many small businesses.

Disadvantages of the LLC

- LLCs do not have a reliable body of legal precedent to guide owners and managers, although LLC law is becoming more reliable as time passes.

- An LLC is not an appropriate vehicle for businesses seeking to become public eventually, or to raise money in the capital markets.

- LLCs are more expensive to set up than partnerships.

- LLCs usually requires annual fees and periodic filings with the state.

- Some states do not allow the organization of LLCs for certain professional vocations.

Considering I am not looking to finance start-up costs and the fees in Indiana are minimal, the LLC is ideal. As a sole-member LLC, taxes are also simply. Earnings and expenses are reported directly on my 1040 during tax time. Unfortunately, start-up costs are high. More on that below.

At the advise of a few local entrepreneurs, I used LegalZoom.com to create my LLC. LegalZoom was simple to use, explaining each step in plain language and simultaneous detail. As a discriminator, LegalZoom even has LLC language if the business is dealing in alcohol or firearms.

There are multiple options from LegalZoom ranging from state registration, including applying for the EIN and state sales tax registrations for you. The basic package is $99 + state filing fees. I opted for the “standard” package, which costs $289. For some, the extra $200 may not be worth it, but the company seal, certificates, and future membership certificates will come in handy when this endeavor lasts long-term. With state filings, my total bill was $381.67.

My order was originally placed on February 19th. There were a few delays with Indiana paperwork, but the completed LLC package was shipped on March 1st. Legalzoom sent e-mails updating me on the package at each step.

EIN

Each business is required to have an Employer Identification Number (EIN). This number is used for tax purposes and to identify the business by Federal & state governments. Also, most banks will require an EIN to open an account

Fortunately, the IRS made this extremely simply. So long as you have your confirmed company name, the IRS process took just ten minutes to get a formal EIN number, sent to me via e-mail and with a downloadable PDF document.

State Tax

Indiana law requires that all business register to collect Indiana Sales tax. Like the EIN, Indiana allows business to file for their Sales Tax registration online (assuming you have an EIN). Indiana charges a $25 fee (plus credit card surcharge). Total was $26.12.

All Set (For Now!)

With the LLC set up and the EIN and Indiana State Tax registration complete, I am currently awaiting the arrival of the LLC paperwork before sending off the completed Form 7.

The next installment in this series will review the Form 7 and the other needed paperwork to complete the FFL application.

Current Running Total for FFL & SOT ($462.78):

- $54.99- FFL123.com Guides

- $381.67 – Creation of my LLC via LegalZoom

- $26.12 – Indiana sales tax registration.

Your Privacy Choices

Your Privacy Choices